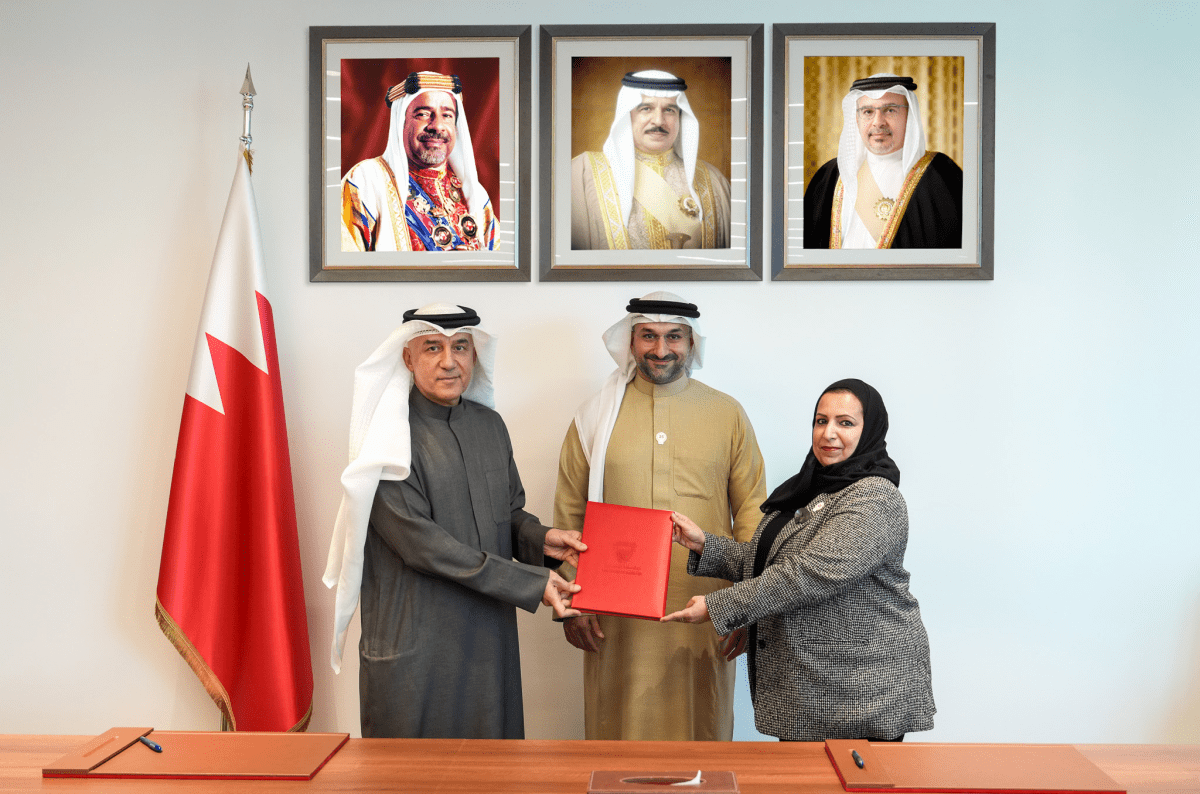

The Ministry of Industry and Commerce and BENEFIT announced the signing of a Memorandum of Understanding (MoU) to develop the corporate credit rating system, with the aim of providing accurate and transparent credit ratings to reflect the financial position of enterprises in the Kingdom of Bahrain, thus facilitating and accelerating SMEs' access to necessary financing to expand their investments.

H.E. Mr. Abdulla bin Adel Fakhro, Minister of Industry and Commerce and Chairman of the SMEs’ Development Council, affirmed the government’s support to this vital sector, under the directives of His Royal Highness Prince Salman bin Hamad Al Khalifa, Crown Prince and Prime Minister, which contributed to empowering it by launching innovative initiatives that facilitate its access to finance to accelerate its growth, given this sector’s pivotal role in developing the national economy.

The Minister added that the MoU signing with BENEFIT is an important step towards strengthening the financial infrastructure of commercial enterprises in the Kingdom of Bahrain. This collaboration reflects our commitment to supporting SMEs by providing innovative solutions that facilitate their access to finance and enhance their ability to grow and compete in the market.

For his part, BENEFIT CEO Abdulwahid Janahi, said: "We are very pleased to sign the MoU with the Ministry of Industry and Commerce, which comes as an important extension of the services of the Bahrain Credit Information Center operated by BENEFIT, especially with regard to the business sector, noting that the development of mutual knowledge between both parties will enhance the development of the commercial sector and the national economy.

This project supports efforts to strengthen the commercial sector in the Kingdom and provides the necessary tools to support economic growth, as it focuses on the development and implementation of an innovative model for evaluating commercial credit rating, which will contribute to improving financing opportunities for SMEs and enhancing the capabilities of financial institutions in assessing credit risks accurately.

The commercial credit rating system is a vital tool that allows businesses to easily access the necessary financing, speed up the approval processes for credit applications, and improve financing conditions. The system is expected to analyze the financial behavior of commercial enterprises, and provide financiers with a tool that facilitates financing decision-making processes, and this cooperation is expected to support the digital transformation in the finance sector, with a focus on supporting small and medium enterprises.